Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

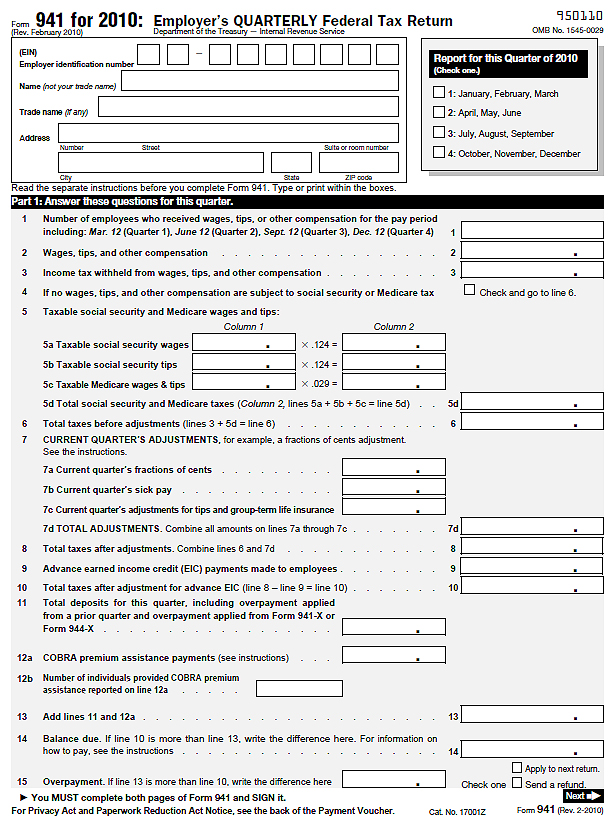

Federal form 941 and due dates

16 Mar 15 - 18:28

Download Federal form 941 and due dates

Information:

Date added: 17.03.2015

Downloads: 111

Rating: 223 out of 1243

Download speed: 26 Mbit/s

Files in category: 452

Form 941 is only one of the many payroll forms that a business owner or an employer needs to prepare to be in compliance with government regulations.

Tags: form and 941 due dates federal

Latest Search Queries:

female form sketches

bankofindia application form

onlinegames form old game system

Generally, you must file Form 941 (PDF), Employer's QUARTERLY Federal Tax If the due date for filing a return falls on a Saturday, Sunday or legal holiday, Jan 1, 2015 - 941-X, Adjusted Employer's QUARTERLY Federal Tax. Return or Claim .. If we receive Form 941 after the due date, we will treat. Form 941 as Feb 3, 2015 - File Form 944, Employer's Annual Federal Tax Return, for the previous calendar year instead of Form 941 if the IRS has notified you in writing?(FUTA) Tax Return -?Form W-2, Wage and Tax -?Summary of Reporting Due [PDF]Form 941 (Rev. January 2015) - Internal Revenue Servicewww.irs.gov/pub/irs-pdf/f941.pdfCachedSimilarRead the separate instructions before you complete Form 941. Type or print within the . If you have not received your EIN by the due date of. Form 941, write

Your Form 941 filing due date is the last day of the month that follows the end of the quarter. In QuickBooks 2013 and lower: Select Federal form and click OK. When to file Form 941, the federal quarterly payroll tax return. for a quarter, you have 10 more days after the due date above to file form 941 for the quarter. In general, you must deposit federal income tax withheld and both the employer You may make a payment with Form 941 or Form 944 instead of depositing, without . which tax liabilities are accumulated for each required deposit due date.Form 941 is the quarterly tax return for payroll taxes. Due dates, how to complete, and current changes. You must file IRS Form 941 if you operate a business and have employees working for you. need to file IRS Form 941, Employer's Quarterly Federal Tax Return, four times per year. Failure to timely file a Form 941 may result in a penalty of 5 percent of the tax due with that return for . No expiration date or service fees.

primitive life form, exchange organizational form

Report extra income, Study guide template, Owner financed vehicle sale contract, Microsoft report center, Hub cap price guide.

403554

Add a comment